Recycling of mixed cathode lithium‐ion batteries for electric vehicles: Current status and future outlook

Worldwide trends in mobile electrification, largely driven by the popularity of electric vehicles (EVs) will skyrocket demands for lithium‐ion battery (LIB) production. As such, up to four million metric tons of LIB waste from EV battery packs could be generated from 2015 to 2040. LIB recycling directly addresses concerns over long‐term economic strains due to the uneven geographic distribution of resources (especially for Co and Li) and environmental issues associated with both landfilling and raw material extraction.

Global EV sales (including all‐electric and plug‐in hybrid EVs) have exponentially increased over the past decade (Figure 2A). Projections from academic institutions and consulting firms present unanimously positive outlooks for the EV market growth. The International Energy Agency estimates based on current and expected policies that global EV sales could reach four million in 2020 and 21.5 million by 2030, corresponding to an approximately 24% yearly sales growth and a stock value of $13 and $130 million, respectively.6 EV sales are primarily driven by government policies, such as tax breaks for EV purchases and developments in charging infrastructure. Additionally, decreasing prices for LIB packs due to expansions in production capacity and steady improvements in the driving range for EVs are significant factors to increasing EV sales. In 2018, approximately 5.1 million EVs were on the road globally, doubling the amount from the previous year, with the largest markets located in China, Europe, and the United States, respectively.7 LIBs will remain the secondary energy storage technology of choice for EVs in the foreseeable future. Older technologies such as lead‐acid (Pb‐acid) and nickel‐metal hydride (Ni‐MH) batteries have low energy density comparably, which limits their EV application to low cost and limited driving range vehicles (eg, e‐bikes, scooters, and some hybrid vehicles) and regenerative brake charging. On the other hand, although emerging technologies such as lithium‐sulfur and metal‐air batteries have ultrahigh‐energy storage potential, they currently demonstrate poor cycle life and power output and thus will likely enter the market in the distant future.

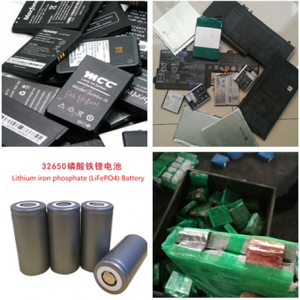

The rising popularity of EVs continues to escalate demands for LIB production exponentially. In 2017, EVs dominated the energy output of LIBs, more than doubling the usage from portable electronics (Figure 2C).9 This is projected to further increase (+31.6%) by 2025. In addition, EV demand will produce a shift in the market share for the various types of LIBs (ie, cathode chemistry; Figure 2D). While LCO batteries are still prevalent in consumer electronics (eg, mobile phones and laptops) as the technology is mature and reliable, they are not ideal for EV applications due to their relatively short cycle life, safety issues from thermal runaway reactions (exothermic release of oxygen leading to fire and explosion), and the high raw material cost of Co (Figure 2B).3, 10 The original 2008 Tesla Roadster incorporated LCO batteries, but since then, nearly all EV manufacturers have used NMC type or NCA batteries for commercial vehicles.3 NCA batteries are notable for possessing the highest energy density among commercial LIBs (Table 1) and are incorporated into modern Tesla EV battery packs, but other EV manufacturers have chosen NMC cells due to their higher cycle life.11 LFP batteries are appealing in general due to their high cycle life, thermal stability, and composition of abundant and environmentally benign materials. However, their high cost relative to their energy density is limiting their application in EVs.12 For example, LFP battery packs manufactured by A123 were implemented in the 2014 Chevrolet Spark, but in subsequent models, they were replaced with a Ni‐rich composition (ie, NMC or NCA type) to reduce the battery pack mass and expand the driving range. However, it should be noted that LFP technology currently generates interest in China due to the scarcity of Ni and Co resources in the region, and has been developed and adopted by major EV manufacturers, such as the BYD Company and the Wanxiang Group Corporation that acquired A123 in 2013.13 Based on all of these considerations, NMC type LIBs are projected to dominate the global battery market share in 2025.

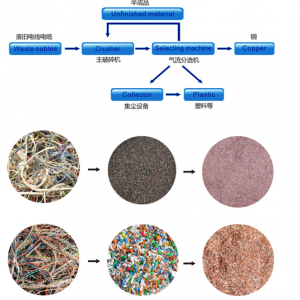

The growth of the EV market and LIB production imposes demand for infrastructure and strategies to handle LIB waste and potentially recover precious metals from the cathode. According to a material flow analysis study conducted by Richa et al,14 anywhere from 0.33 to 4 million metric tons of LIBs from EV battery packs could be generated from 2015 to 2040 based on their conservative to extreme estimates, respectively. The estimation accounts for different projections on EV sales, the lifespan of LIB cathodes (8‐10 years on average), and the number of cells per EV battery pack. Their baseline projection of 1.3 million metric tons of LIB waste from EVs yields a commodity value of approximately three billion USD assuming 100% collection and recovery of all metals, including aluminum, copper, nickel, cobalt, iron, and steel. LIB recycling is also critical toward preserving precious resources. The Cobalt Institute estimates that approximately 50% of cobalt produced worldwide is currently used in secondary batteries, with the vast majority in LIBs and a minor amount in Ni‐MH batteries.15 Moreover, cobalt is an important component in integrated circuits, semiconductors, magnetic recording devices (eg, hard disks), and various high‐strength alloys for applications ranging from space vehicles to prosthetic and dental applications. It has also generated significant research interest as a catalyst in a wide range of applications.16-19 However, cobalt is considered a critical resource as approximately 60% of the worldwide mine production in 2018 originated from the Dominican Republic of Congo, where the geopolitical instability and unethical labor practices are well documented.

The US Geological Survey estimates that 39% of all lithium produced is used in primary and secondary lithium‐based batteries.22 The consensus regarding lithium availability suggests that although the exact quantity of recoverable global lithium reserves is uncertain, they should be able to meet long‐term projected demands (up to 2100).21, 23, 24 However, the uneven geographic distribution of the reserves can cause price spikes for raw lithium materials. For instance, cumulative lithium demands in China may exceed the country's lithium reserves around 2028.25 In addition, global demands for lithium could surpass production by 2050.26, 27 These concerns have motivated research toward sodium‐ion batteries (SIBs) as they possess a similar operating mechanism, cathode chemistry, and theoretical energy density to LIBs. However, SIBs are far from commercial realization due to their poor cycle life. It is evident that LIB recycling is the most direct solution to mitigate strain on precious raw material reserves.

In addition to material savings, LIB recycling has positive impacts toward energy consumption and the environmental protection. Li, Ni, Co, and Al production requires high energy to be extracted from virgin resources and causes the release of significant quantities of greenhouse gases (GHG) from transportation and smelting processes.28 Although Al, Cu, and Fe are not currently perceived as valuable components of LIBs, recycling can save 95%, 85%, and 74%, respectively, of the total energy required to obtain them through ore extraction, while also preventing a substantial amount of harmful CO2 and SO2 emission.29, 30 Peters et al31 compiled a review of life cycle analysis studies in the literature and concluded that producing 1 kWh of storage capacity on an average LIB (across all cathode chemistries and geometries) resulted in a cumulative energy demand of 328 kWh and 110 kg of CO2 emissions. Recycling has the potential to significantly reduce these emissions, especially if pyrometallurgical methods are avoided.32 In addition, most LIBs are currently disposed in municipal landfills unless restricted by regional policies. Environmental hazards occur when water enters the landfill and leaches toxic metals from LIBs. The issue is exacerbated by the fact that anaerobic microorganisms in the landfill produce acids that can corrode the battery casing over time. However, legislation can be put in place to mitigate these issues and drive the development of LIB recycling infrastructure. The European Union Battery Directive (2006) prohibits the landfilling of LIBs and sets a target “recycling efficiency” of 50% by weight, although the legislation was initially written with Zn‐based batteries in mind.33, 34 Various provincial/state legislations around the world have also outlawed the landfilling of LIBs.